10 Reasons Why Payments Fail – and What You Can Do About Them

One of the main appeals of shopping online is convenience. Consumers don’t need to leave their houses and they can get everything they need delivered directly to their homes.

However, between the ordering and receiving of goods, there is a crucial middle step that needs to take place: online payment. Consumers who want to pay online via credit card want the process to be simple and easy, just like the rest of the online shopping process.

Sometimes, however, the payment process hits a snag and the transaction fails. When that happens, consumers are likely to abandon their shopping carts and go to a different site that won’t give them any problems.

In fact, 62% of consumers who experience a failed online transaction won’t return to the same website.

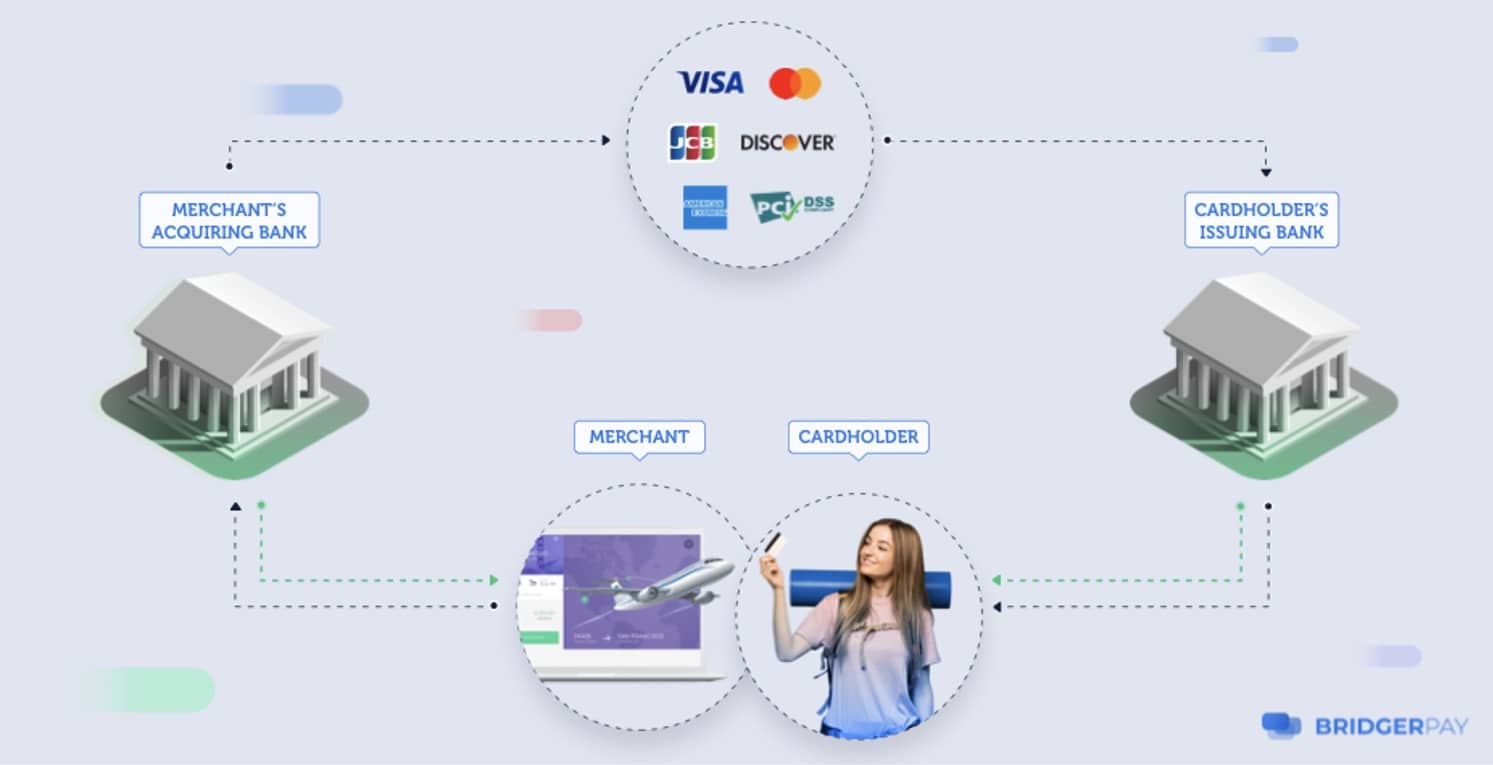

What can merchants do about it? The first step in battling failed transactions is understanding exactly how the online credit card process takes place.

There are seven players involved in the entire online credit card payment process:

- The cardholder

- The issuing bank (the cardholder’s bank)

- A gateway through which the transaction from the merchant to the processor occurs

- A processor that sends the merchant their money at the end of the payment flow

- An acquirer that collects the money for the merchant

- Card scheme/network rails, used by the acquirer to move funds from the card to the merchant

- The merchant

So, while the online credit card payment process seems simple enough from a consumer’s perspective, there are actually quite a lot of steps involved.

If just one of the steps or players breaks down, the transaction will fail. When payments are denied, consumers are more likely to abandon their carts and not return to the same online merchant.

10 Reasons Why Payments Fail

- Deemed inauthentic – If an issuing bank or acquirer deems that the attempted transaction is not authentic based on the consumer’s previous charge history, they will deny permission for it to go through.

- Location – Banks and acquirers can also deem a charge inauthentic if the consumer is trying to pay from abroad. Additionally, not all credit cards support international charges.

- Spotty internet connection – A stable internet connection is the backbone of any online transaction. When a consumer’s connection isn’t stable, they can try paying at multiple sites and will always end up frustrated.

- Downtime/maintenance – Sometimes, payment gateways, processors or issuing banks have downtime, during which the site is being repaired or updated. This can lead to a failed transaction.

- Payment method not supported – Not all online merchants accept all types of credit cards. When this happens, a consumer can enter their information, but ultimately the transaction will be rejected.

- 3DS2 friction– 3DS2, a multifactor authentication protocol, is designed to reduce friction in the online checkout process. Merchants and banks can share information quickly and determine if a transaction is risky. If it’s fine, it goes right through. If it’s risky, the customer is required to provide an additional piece of information, like a fingerprint, face scan, or one-time password. If a customer isn’t able to provide this information or doesn’t want to, the payment can fail.

- Insufficient funds – In some cases, the issuing bank determines that the cardholder doesn’t have enough money to pay for the items. In this case, the payment will be denied.

- Exceeding the single charge limit – Some consumers have sufficient funds but are limited in how much they can spend in one transaction. If they try to buy something that’s over that limit, the transaction can be denied.

- Mismatched data – If the cardholder enters data that doesn’t match the information the issuing bank has on file; the transaction can be denied. This can include a wrong card number or wrong password.

- Expired credit card – If the consumer provides outdated information, the transaction won’t go through.

What Can Online Merchants Do to Combat Payment…

Read More: 10 Reasons Why Payments Fail – and What You Can Do About Them